The dynamic landscape of investments offers investors a diverse range of options to distribute their capital. Among these, S&P 500 Sector ETFs have emerged as popular choices for achieving exposure to specific markets. These ETFs track the performance of companies within a particular sector, enabling investors to hone in on their portfolio allocations based on niche growth prospects.

By scrutinizing the returns of various S&P 500 Sector ETFs, investors can gain valuable understanding into current market trends and pinpoint potential growth opportunities.

- Recognizing the returns of different sectors allows investors to diversify their portfolios effectively.

- Past performance data can serve as a guide for future expectations.

- Relative analysis of sector ETFs can reveal the strengths and weaknesses of different industries.

Furthermore, factors such as market conditions, policy changes, and sectoral developments can substantially impact the performance of S&P 500 Sector ETFs.

Unlocking Alpha: Top-Performing S&P 500 Sector ETFs

The S&P 500 sector ETFs deliver a efficient way to invest in distinct segments of the U.S. economy. For portfolio managers seeking to maximize returns, pinpointing top-performing ETFs within each sector can be crucial. Exploiting on market trends and sectoral strengths is key to securing alpha.

- Consider ETFs that have consistently exceeded their benchmarks.{

- Scrutinize the constituent companies of each ETF to determine its volatility profile.

- Keep abreast on sectoral news and developments that may impact ETF performance.

Note that past performance are not necessarily indicative of future returns. It is vital to conduct thorough due diligence and discuss with a wealth manager before making any investment decisions.

Exploring the Market with S&P 500 Sector ETFs: Portfolio Strategies for Triumph

Embarking on an investment journey within the dynamic realm of the stock Technology ETFs with 3x leverage market can often feel like navigating uncharted territory. However, investors seeking to capitalize on specific sectors of the economy can benefit from utilizing Exchange-Traded Funds (ETFs) that track the performance of the S&P 500 index. These sector-specific ETFs offer a structured approach to diversifying your portfolio and potentially enhancing returns. By strategically selecting ETFs that align with your financial goals, you can efficiently minimize risk while harnessing the growth potential of individual sectors.

- Consider your investment objectives and risk appetite.{

- Conduct thorough analysis on various S&P 500 sector ETFs, paying attention to their returns and costs.{

- Utilize a well-defined investment strategy that includes regular adjustments to maintain your portfolio composition.{

Remember that past performance is not indicative of future results. It's crucial to persistently monitor your investments and adapt your strategy as needed to navigate in the ever-changing market landscape.

Best S&P 500 Sector ETFs for Your Portfolio in 2023

Navigating the dynamic landscape of the stock market can be tricky, especially when it comes to identifying sectors that have the potential for solid growth. This is where S&P 500 sector ETFs come into play, offering a specific approach to investing your portfolio across various industries.

In 2023, particular sectors are poised to thrive due to favorable market conditions. Investors looking to maximize their returns should explore these high-performing ETFs that capture the essence of these promising sectors.

- Software

- Biotech

- E-commerce

It's essential to undertake thorough research and speak with a financial advisor before implementing any investment decisions.

Analyzing S&P 500 Sectors for Investment Potential

In the dynamic world of finance, investors continually seek out avenues to amplify their returns. Examining sector-specific Exchange Traded Funds (ETFs) tied to the S&P 500 can offer a effective approach to identifying attractive growth opportunities.

- By thoroughly evaluating various sectors, investors can uncover ETFs that align with their investment goals and expected returns.

It's essential to conduct a in-depth analysis of each sector's trajectory. Factors such as market dynamics play a significant role in shaping the forecast for individual sectors.

- For instance, investors might favor ETFs in sectors experiencing strong development, such as technology or healthcare, while implementing caution with sectors facing headwinds.

Staying aware of policy shifts is also imperative for taking prudent investment decisions.

Targeted Growth: Leveraging S&P 500 Sector ETFs

For discerning investors seeking to amplify returns, specialization within the broad realm of the S&P 500 can be a potent approach. Sector-specific ETFs offer a targeted instrument to participate in the growth and performance of individual industries, allowing you to synchronize your portfolio with specific market shifts. By focusing capital towards sectors exhibiting robust fundamentals, investors can minimize overall portfolio risk while pursuing meaningful gains.

- Consider sector ETFs in areas such as technology, healthcare, or energy, where innovation are poised to drive future growth.

- Review the underlying holdings of each ETF to ensure correspondence with your investment goals.

- Allocate your sector exposure across multiple ETFs to create a well-rounded portfolio that can navigate market fluctuations.

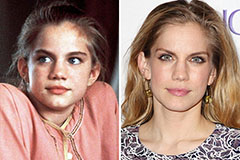

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!